How to Get Car Insurance for a Luxury Car in the UK

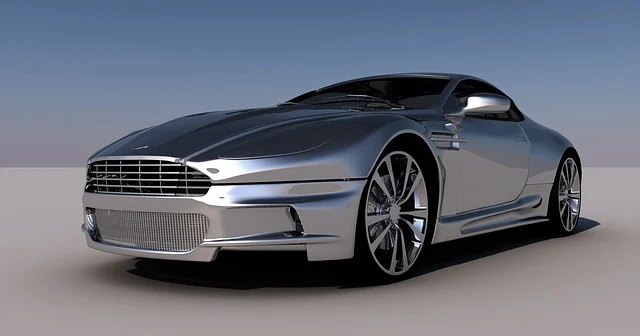

Owning a luxury car is a dream come true for many. Whether it’s a sleek Ferrari, a powerful Lamborghini, or a sophisticated Rolls-Royce, these vehicles are not just modes of transportation—they’re symbols of status, craftsmanship, and exclusivity. However, insuring such high-value cars comes with its own set of challenges and considerations. In this comprehensive guide, we’ll walk you through everything you need to know about getting car insurance for a luxury vehicle in the UK, ensuring your prized possession is protected while keeping costs manageable.

Understanding the Unique Challenges of Insuring a Luxury Car

Luxury cars are different from standard vehicles in several ways, which directly impacts their insurance requirements:

- Higher Replacement Costs : Luxury cars often have expensive parts that are harder to source and repair compared to regular cars.

- Specialized Repairs : Only certified technicians and authorized dealerships can handle repairs for most luxury vehicles, increasing labor costs.

- Increased Risk of Theft : High-end cars are more attractive targets for thieves, making theft coverage essential.

- Performance Features : Many luxury cars boast advanced performance capabilities, which may raise concerns among insurers about potential speeding or reckless driving incidents.

Given these factors, finding the right insurance policy requires careful planning and research.

Step 1: Assess Your Coverage Needs

Before shopping for insurance, determine what type of coverage suits your needs. Here are the main types of car insurance policies available in the UK:

Third-Party Only (TPO)

This is the minimum legal requirement in the UK, covering damage caused to other people or property but offering no protection for your own vehicle. While TPO might be affordable, it’s rarely sufficient for luxury cars due to their high value.

Third-Party, Fire, and Theft (TPFT)

This level adds fire and theft protection on top of third-party liability. It’s slightly better than TPO but still leaves significant gaps when insuring a luxury car.

Comprehensive Insurance

Also known as “fully comp,” this offers the highest level of protection, including accidental damage, vandalism, natural disasters, and more. For luxury car owners, comprehensive insurance is almost always the best choice because it ensures full financial protection against unforeseen events.

Step 2: Compare Quotes from Multiple Providers

Shopping around is crucial when seeking insurance for a luxury car. Premiums vary widely between providers based on factors like age, driving history, location, and even credit score. To get the best deal:

- Use online comparison tools like Compare the Market, MoneySuperMarket, or Confused.com to gather quotes quickly.

- Contact specialist brokers who focus exclusively on insuring high-value vehicles. These brokers often partner with niche insurers familiar with luxury cars’ unique demands.

- Don’t forget to check if your manufacturer offers exclusive insurance deals. Brands like Porsche, BMW, and Mercedes-Benz sometimes collaborate with insurers to provide tailored packages.

Step 3: Optimize Your Policy with Add-Ons

Luxury car insurance isn’t one-size-fits-all. Tailor your policy by adding optional extras that enhance protection and convenience:

Agreed Value Coverage

Unlike standard policies that depreciate your car’s value over time, agreed value coverage locks in the current market price of your vehicle. This ensures you receive fair compensation if your car is totaled or stolen.

Courtesy Car Provision

If your luxury car is being repaired after an accident, having access to a courtesy car can make life easier. Ensure your policy includes this benefit so you won’t be stranded without transportation.

Track Day Cover

For enthusiasts who enjoy taking their luxury cars to track days, specialized coverage allows you to drive safely without voiding your policy.

Key Replacement Protection

Losing your keys to a luxury car can cost thousands of pounds to replace. Adding key replacement protection safeguards against this costly scenario.

Step 4: Lower Your Premiums Without Sacrificing Coverage

Insuring a luxury car doesn’t have to break the bank. Implement these strategies to reduce your premiums:

Increase Your Excess

Opting for a higher voluntary excess lowers your premium since you agree to pay more out-of-pocket in case of a claim. Just ensure the amount remains affordable.

Install Security Features

Modern security systems like GPS trackers, immobilizers, and alarm systems significantly reduce the risk of theft, prompting insurers to offer discounts.

Build a No-Claims Bonus

Maintaining a clean driving record builds up your no-claims bonus, which reduces future premiums. Some insurers also allow transferring bonuses from previous policies.

Limit Mileage

If you don’t drive your luxury car frequently, consider capping your annual mileage. Fewer miles mean less exposure to accidents, leading to lower rates.

Step 5: Work with Reputable Insurers Specializing in Luxury Vehicles

Not all insurers are equipped to handle luxury cars effectively. Partnering with companies experienced in high-value assets ensures superior service and expertise. Some top names include:

- Admiral Prestige

- Hagerty UK

- Lockton Performance

- Footman James

These providers understand the intricacies of insuring luxury vehicles and can offer bespoke solutions tailored to your specific needs.